Help docs

Welcome to Prism BTC!

Prism BTC offers leading quantitative Bitcoin price analysis.

At Prism BTC, you will find a variety of specialized Bitcoin pricing models, each with its own perspective on the price of Bitcoin. With this information you will be able to more confidently know where the price of Bitcoin is treading in the macro-economic scene.

Please note that Prism BTC is not a financial advisor. We are not able to recommend any stake in Bitcoin. We are simply providing information about Bitcoin and offering analysis on its price.

Prism BTC's provides information on the price of Bitcoin through many Bitcoin pricing models. You can think of a price model as a something that measures the price of Bitcoin and says if the price is high or low given the current macro situation. Every model automatically monitors and analyzes unique features about the Bitcoin network. By doing this, each model discovers patterns in Bitcoin's blockchain data and calculates if the price is high or low compared to historical trends.

Every model is uniquely built by Prism BTC with a technique called Quantitative Analysis. This technique uses mathematical and statistical methods to analyze Bitcoin. Our models at Prism BTC are valuable because they are unbiased. The models do not have any stake in Bitcoin. They have no ulterior motive. They provide an unfiltered analytical view of the Bitcoin network.

How to use Prism BTC

Step 1

Explore our modelsEach model offers:

- A description of the model

- The model's expected trend duration (time horizon)

- The model's historic price analysis

- The model's current price analysis (for paid subscribers only)

Step 2

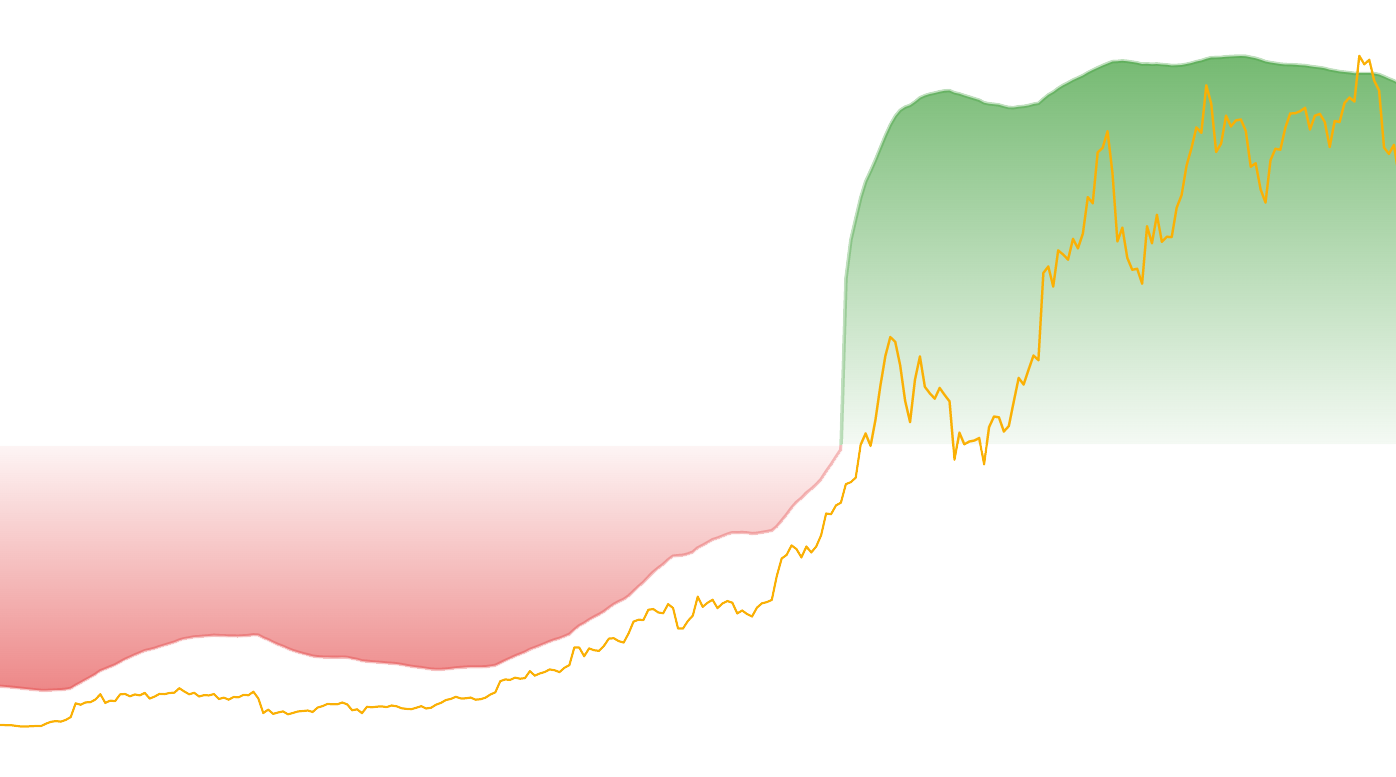

Discover price highs and lowsEach Prism BTC price model gives a Price Indicator. A Price Indicator is a signal for how balanced the price of Bitcoin is relative to past historical trends. It will look something like this:

80 ▲

25 ▼

100 ▼

A Price Indicator is represented as two parts:

- A number of "points" between 0 to 100.The points indicate how strongly ABOVE or BELOW the price is.

- An arrow (▲ or ▼ or ▶).The arrow indicates of the price is ABOVE ▲, BELOW ▼, or BALANCED ▶ with past historical trends.

Interactive Demo

priced fair/even

0 ▶

Bottom

Balanced

Top

Examples

Price Indicator | Description |

|---|---|

100 ▲ | Price has reached the predicted top of the historical trend. The model predicts the price will not incline further. |

50 ▲ | Price leaning high, with more room to fall. |

0 ▶ | Price is balanced. The price has equal room to go up as it does to go down. |

50 ▼ | Price leaning low, with more room to rise. |

100 ▼ | Price has reached the predicted bottom of the historical trend. The model predicts the price will not decline further. |

How it works under the covers

Prism BTC provides access to it's Bitcoin price models. Each model uses an automated computation technique, called Quantitative Analysis.

Quantitative analysis is a technique that uses mathematical and statistical modeling, measurement, and research to understand behavior. Quantitative analysts represent a given reality in terms of a numerical value.Investopedia.com

Quantitative analysis is a powerful technique used by large trading firms, even outside the realm of cryptocurrencies. The significant advantages of quantitative analysis include:

- Speed - These computations can be completed in seconds.

- Precision - The numbers provide very specific analysis, making it clear where things stand.

- Objectivity - The models will not succumb to human biases or tendencies.

Our models have been custom-built by our research team. You will not find these models anywhere else. Our research team continues to work on our pricing models to offer the best Bitcoin price analysis available.

Frequently Asked Questions